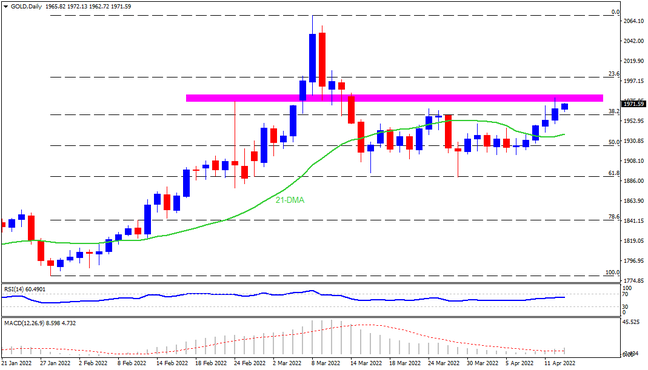

Gold refreshed its monthly high as strong US inflation underpins the safe-haven demand for the metal. In doing so, the bullion also justifies late March’s rebound from 61.8% Fibonacci retracement of January-March upside, as well as the ability to stay beyond the 21-DMA. However, the precious metal is yet to cross a seven-week-old horizontal resistance zone, around $1,975-80, which in turn requires the bull’s caution. Also acting as an extra upside filter is the 23.6% Fibo level surrounding $2,001, a break of which will highlight the latest peak of $2,070.

Meanwhile, the 38.2% Fibonacci retracement level near $1,960 and the 21-DMA of $1,937 could test the short-term sellers of gold. However, the bulls remain hopeful until the quote stays beyond the 61.8% Fibonacci retracement level around $1,891. Should the commodity drop below the key Fibo level, late January’s swing high around $1,853 and the $1,800 threshold can offer additional support to the prices before directing them to the yearly low of $1,780.

Overall, gold buyers are in the form but they must overcome the crucial barrier before eyeing further ruling.

Join us on FB and Twitter to stay updated on the latest market events.