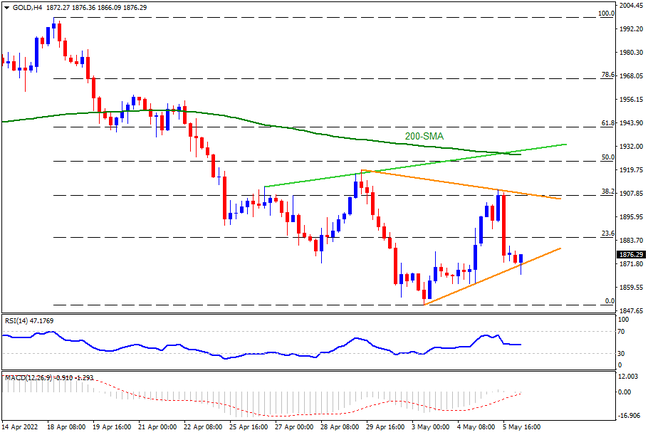

Despite reversing the post-Fed rally, gold prices remain beyond a three-day-old ascending support line, around $1,870 by the press time, ahead of the US Nonfarm Payrolls (NFP) release on Friday. In addition to the capacity to stay beyond immediate support, firmer RSI and bullish MACD signals also keep buyers hopeful as markets brace for the key data. That said, late April’s swing high around $1,920 acts as an immediate hurdle for the metal to knock before targeting the $1,930 crucial resistance, comprising 200-SMA and upward sloping trend line from April 26. Should the scheduled data allow the quote to cross $1,930, backed by an absence of overbought RSI conditions, $1,960 could return to the charts.

On the contrary, pullback moves remain less important until gold remains above $1,870. Following that, the weekly low surrounding $1,850 may test the bears. If at all the bullion prices drop below $1,850, a nine-month-old rising support line around $1,835 will be crucial to watch as a daily closing beneath the same could open doors for the south-run targeting the sub-$1,800 zone.

Overall, gold is due for a short-term recovery before an important piece of US economics.

Join us on FB and Twitter to stay updated on the latest market events.