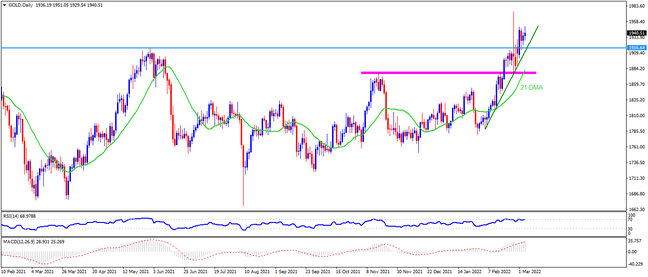

Gold seesaws around weekly tops after poking $1,951 during early Friday. In doing so, the bullion remains well above short-term key supports ahead of crucial US jobs data. Also keeping gold buyers hopeful is the ongoing Russia-Ukraine standoff. That said, overbought RSI conditions and recently easing bullish bias of the MACD hint at gold’s extended pullback towards June 2021 peak of $1,916, a break of which will direct the sellers towards a monthly support line near $1,906 and then to the $1,900 threshold. However, a convergence of the 21-DMA and multiple levels marked since mid-November 2021, around $1,877-75, will keep the gold bears away. It should be noted, though, that a clear downside break of $1,875 will make the precious metal vulnerable to portray a bearish trend with January’s peak of $1,853 acting as the next support.

Meanwhile, a successful upside beyond the weekly top near $1,950 becomes necessary before directing gold buyers towards the latest peak of $1,974, also the highest level since September 2020. During the bullion’s run-up beyond $1,974, the $2,000 round figure and $2,015 may act as buffers ahead of highlighting the year 2020 top close to $2,075.

Overall, gold buyers remain in the driver’s seat but a pullback can’t be ruled out if the US dollar gets favorable numbers of the US Nonfarm Payrolls (NFP).

Join us on FB and Twitter to stay updated on the latest market events.