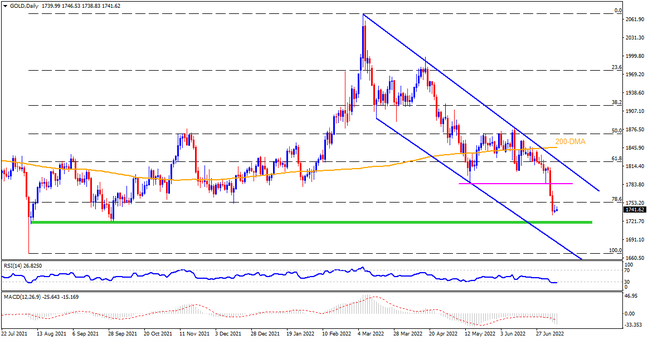

Gold remains inside a four-month-old descending trend channel despite a recent corrective bounce off the yearly low, mainly due to the oversold RSI. The recovery moves, however, failed to cross the 78.6% Fibonacci retracement of the metal’s upward trajectory from August 2021 to March 2022, near $1,755. In addition to the $1,755 hurdle, a horizontal area comprising lows marked since mid-May also restricts the quote’s short-term advances near $1,786. In a case where the bullion prices rally beyond $1,786, the 61.8% Fibonacci retracement and the stated channel’s upper line, respectively around $1,820 and $1,828, will lure the bulls. It’s worth noting that the upside momentum past $1,828 will need validation from the 200-DMA level surrounding $1,846 to welcome the buyers.

On the contrary, an 11-month-long horizontal support zone near $1,721-17, restricts the precious metal’s immediate downside. Following that, the aforementioned channel’s lower line, around $1,681, could act as the last defense of gold buyers before directing the quote towards the previous yearly low of $1,667.

Overall, gold prices may extend the latest rebound if today’s US Nonfarm Payrolls (NFP), or any of the June US jobs report data, disappoints the US dollar buyers. However, the bears can keep reins until the quote rallies past $1,846.

Join us on FB and Twitter to stay updated on the latest market events.