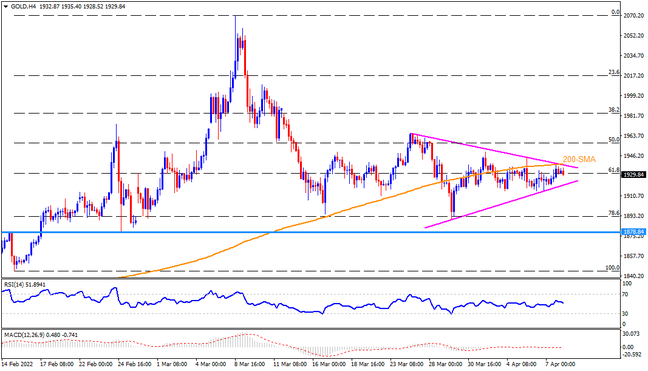

Gold prices have been in a choppy range between $1,915 and $1,950 since the start of April. In doing so, the metal observes a short-term triangle formation, suggesting a further sideways grind. However, sustained trading below the 200-SMA and sluggish oscillators keep sellers hopeful. That said, a clear downside break of the stated triangle’s support, around $1,920 by the press time, becomes necessary for fresh selling. Following that, a downward trajectory towards horizontal support from mid-February, near $1,878, will become imminent to appear on the chart. Though, the $1,900 threshold may offer an intermediate halt while February 15’s swing low surrounding $1,844 could challenge the bears afterward.

Alternatively, recovery moves remain elusive until the bullion stays below the $1,939-40 resistance confluence, comprising 200-SMA and the resistance line of the two-week-long triangle. Even if the gold buyers manage to cross the $1,940 hurdle, the late March swing high near $1,966 and February’s high of $1,977 will act as validation points for a run-up targeting the $2,000 psychological magnet. Also challenging the quote is March 10’s high near $2,010, a break of which will give control to the bulls.

Join us on FB and Twitter to stay updated on the latest market events.