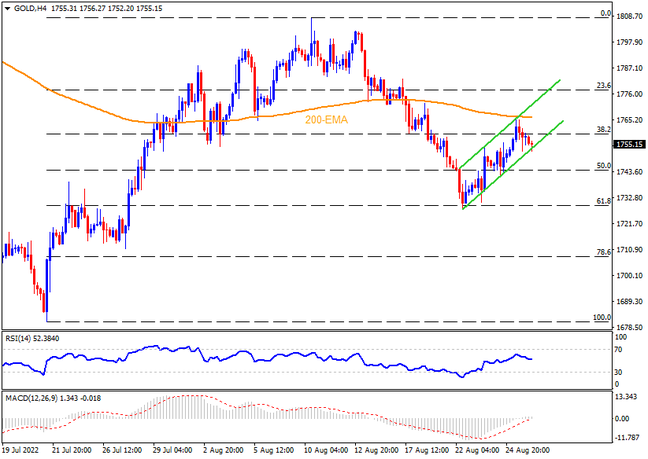

Gold fades the bounce off 61.8% Fibonacci retracement of July-August moves as traders await Fed Chair Jerome Powell’s appearance at the annual Jackson Hole Symposium. In doing so, the yellow metal not only takes a U-turn from the 200-EMA but also portrays a bearish flag formation in the four-hour play. However, the quote’s further downside hinges on its sustained trading below $1,750. Following that, the south-run towards the key Fibonacci retracement support at $1,728, also known as the golden ratio, appears imminent during the theoretical slump targeting the fresh monthly low near $1,670. That said, multiple lows marked during late July near $1,712-10, precede July’s monthly bottom of $1,684 to offer an intermediate halt during fall.

Meanwhile, the 200-EMA and upper line of the flag, respectively around $1,766 and $1,770, guard the short-term recovery of the gold prices. Also acting as the short-term upside hurdle is the area comprising multiple lows marked during August 09-11, close to $1,785, as well as the August 04 peak near $1,795 and the $1,800 threshold. In a case where XAUUSD remains firmer past $1,800, the bulls can aim for the monthly top surrounding $1,808, as well as the mid-June swing high near $1,860.

Overall, gold bears have an upper hand ahead of the key event. Should Powell upends the market’s hopes of speaking dovish, the bullion prices are likely to witness a notable downside.

Join us on FB and Twitter to stay updated on the latest market events.