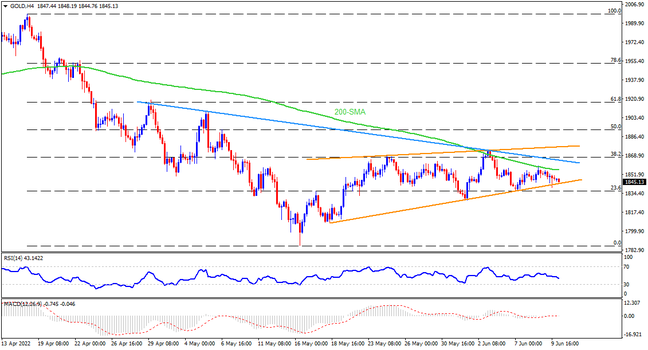

Gold prices remain sustainably below 200-SMA since late April, pressured inside a three-week-old rising wedge of late. Given the steady RSI and sluggish MACD, the bearish bias is likely to prevail. However, a clear downside break of the stated wedge’s support, around $1,844, becomes necessary to confirm the downward trajectory towards the yearly low marked in May, near $1,786. It’s worth noting that $1,830 and $1,810 are likely intermediate halts before directing bears towards $1,786.

On the contrary, an upside break of the 200-SMA, close to $1.,856, isn’t an open invitation to the gold buyers as a six-week-old descending resistance line and the upper line of the stated wedge, respectively around $1,865 and $1,875, could test the advances. In a case where the precious metal rallies beyond $1,875, May’s high of $1,910 and late April top surrounding $1,920 could lure the bulls.

Overall, gold buyers appear to have run out of steam but the bears need validation from both $1,844 and US inflation data.

Join us on FB and Twitter to stay updated on the latest market events.