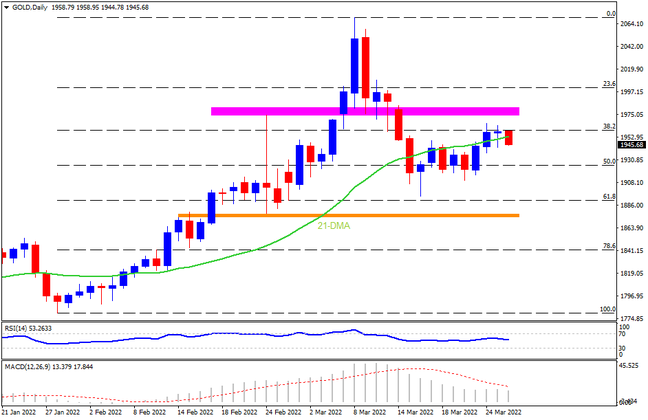

Gold struggles to defend Thursday’s daily closing the 21-DMA, the first in two weeks. Even so, firmer RSI, not overbought, keeps gold buyers hopeful to battle a one-month-old horizontal resistance area surrounding $1,975-80. Should gold buyers cross the 1,980 hurdle, the $2,000 threshold will be in focus. That being said, a daily closing beyond the $2,000 round figure will underpin the run-up towards the $2,050 level before the monthly approaching the monthly high surrounding $2,070.

On the contrary, a daily closing below the 21-DMA level of 1,950 will drag the quote towards mid-March’s bottom near $1,895. It’s worth noting that the metal’s downside past $1,895 will be challenged by a horizontal area comprising multiple levels marked since February, around $1,875. In a case where gold prices drop below $1,875, the bulls have to step back, at least for a while, suggesting further declines towards January’s bottom surrounding $1,780.

Overall, gold prices are likely to witness sideways momentum but an upside clearance of the $1,980 can have more acceptance.

Join us on FB and Twitter to stay updated on the latest market events.