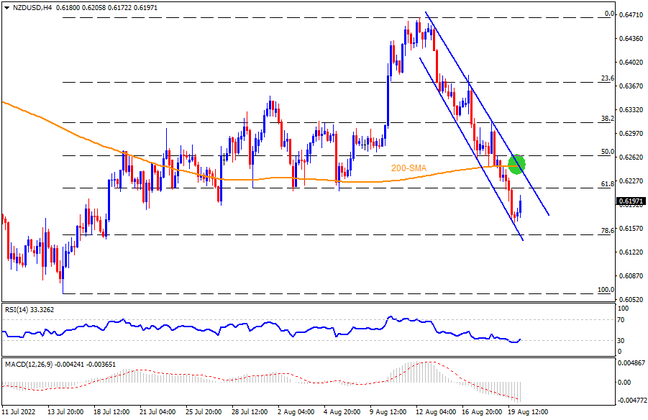

NZDUSD bounces off a five-week low as it extends the corrective pullback from a weekly falling channel’s support line. In doing so, the Kiwi pair also traces the oversold RSI while approaching the 61.8% Fibonacci retracement level of July-August moves, around 0.6215. The quote’s further upside, however, remains doubtful as the 200-SMA and upper line of the stated channel, close to 0.6250, will challenge the bulls afterward. Should the pair rise past 0.6250, the 0.6300 round figure may act as an intermediate halt during the run-up towards the early August swing high, near 0.6350-55.

Alternatively, pullback moves may revisit the support line of the aforementioned channel and the 78.6% Fibonacci retracement level, around 0.6150, will be a crucial support. In a case where the NZDUSD bears conquer 0.6150 support, the southward trajectory towards the yearly low marked in July, near 0.6060, followed by the 0.6000 psychological magnet, can’t be ruled out.

Overall, NZDUSD is likely to witness further recovery but the upside momentum has limited room to the north.

Join us on FB and Twitter to stay updated on the latest market events.