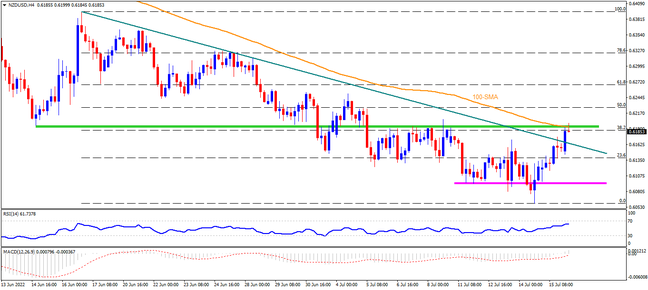

NZDUSD ended the third loss-making week on a positive side, by marking the biggest daily gains in three weeks. The Kiwi pair, however, couldn’t cross a one-month-old resistance line, which in turn joins steady RSI to keep sellers hopeful. Even if the quote rises past 0.6170 hurdle, a horizontal area from mid-June around 0.6200, comprising the 100-SMA, appears a tough nut to crack for the pair buyers. Though, a successful break of 0.6200 could quickly propel the quote towards 0.6250 before teasing the bulls to aim for the 78.6% Fibonacci retracement of the June-July downside, near 0.6325.

On the other hand, pullback moves may initially rest around the 0.6100 support before challenging the recently flashed two-year low around 0.6060. In a case where NZDUSD remains bearish past 0.6060, the 0.6000 psychological magnet will be important to watch as a clear break of the same could direct sellers toward May 2020 low near 0.5920.

Fundamentally, the recent New Zealand inflation data came in firmer than expected and raised possibilities of aggressive rate hikes from the Reserve Bank of New Zealand (RBNZ), keeping NZDUSD bulls hopeful.

Join us on FB and Twitter to stay updated on the latest market events.