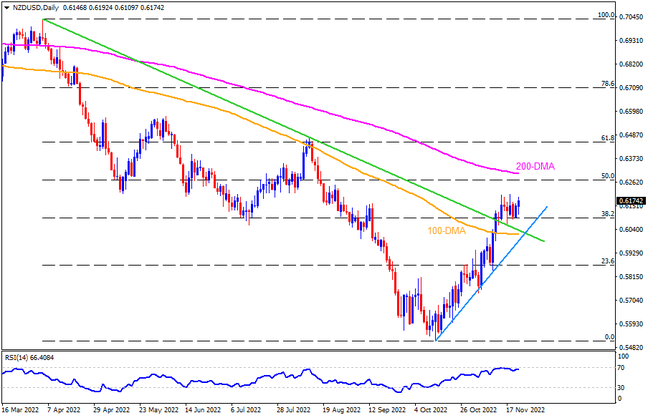

Despite the RBNZ-led volatility, NZDUSD defends the early month breakout of the 100-DMA and a downward-sloping trend line from April 05. That said, the 38.2% Fibonacci retracement level of the pair’s April-October downturn, near 0.6090, restricts the Kiwi pair’s immediate declines ahead of the aforementioned resistance-turned-support line, close to 0.6040 at the latest. Following that, the 100-DMA and a six-week-old ascending trend line, respectively near 0.6015 and the 0.6000 round figure, could act as the last defenses of the pair buyers before welcoming the bears.

Meanwhile, the pair’s upside momentum needs a daily closing beyond the monthly high surrounding 0.6205 to convince NZDUSD buyers. In that case, the 50% Fibonacci retracement and the 200-DMA, close to 0.6270 and 0.6305 in that order, will be in the spotlight. Should the New Zealand dollar remains firmer beyond the 200-DMA, the 61.8% Fibonacci retracement, also known as the golden ratio, might probe the north-run near 0.6455, a break of which won’t hesitate to challenge the tops marked in May-June around 0.6570-75.

Overall, NZDUSD is likely to remain the bull’s favorite unless breaks the 0.6000 threshold.

Join us on FB and Twitter to stay updated on the latest market events.