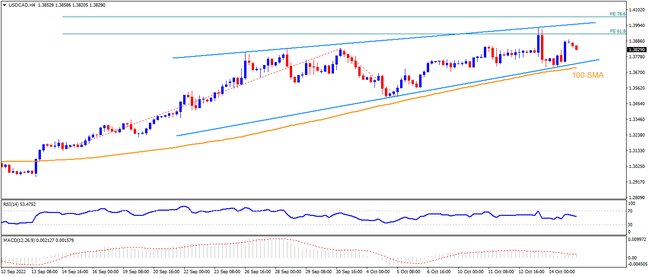

USDCAD retreats from the highest level in 29 months as bulls appear to run out of steam. That being said, the recent moves of oscillators and the rising wedge bearish formation on the top teases sellers at the multi-month top. However, a clear downside break of the stated pattern’s support line, around 1.3930 by the press time, as well as the smashing of the 100-SMA level of 1.3695, becomes necessary for the bears. Following that, a south-run towards the monthly low near 1.3500 seems quick on the way to the theoretical target of 1.3400.

Alternatively, the 61.8% Fibonacci Expansion (FE) of the USDCAD pair’s moves between September 14 and October 05, around 1.3935, could lure the intraday buyers ahead of the aforementioned wedge’s top, close to the 1.4000 psychological magnet. In a case where the quote stays firmer past 1.4000, the 78.6% FE level near 1.4050 could challenge the upside momentum before directing the bulls towards the May 2020 peak surrounding 1.4175.

Overall, USDCAD grinds higher inside a bearish chart formation to appear risky for the fresh long positions.

Join us on FB and Twitter to stay updated on the latest market events.