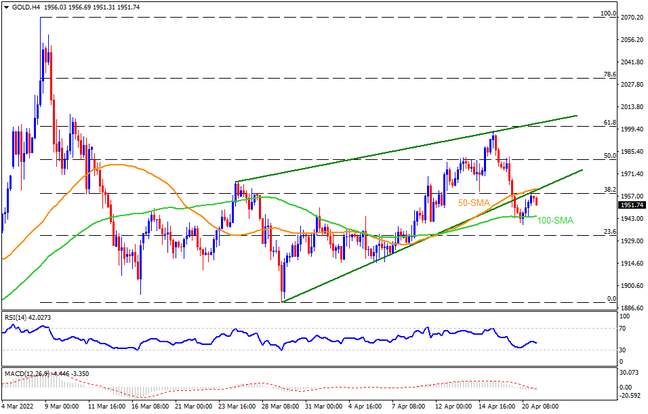

Despite bouncing off 100-SMA, gold prices fail to reject the rising wedge bearish chart pattern confirmation portrayed on Tuesday. The downbeat RSI and MACD conditions also support the recent pullback targeting the 100-SMA level of $1,945. Following that, the monthly low surrounding $1,890 will gain the market’s attention ahead of the theoretical target of the stated wedge, near $1,850.

Meanwhile, 50-SMA joins the previous support line of the bearish formation and challenges gold buyers at around $1,965. Should the metal prices rise past $1,965, recovery moves can aim for the 50% Fibonacci retracement of March month’s downside near $1,980. However, a convergence of the rising wedge’s resistance and the 61.8% Fibonacci retracement level, around $2,005, will be a tough nut to crack for the bulls.

Other than the technical details, today’s speech from Fed Chair Jerome Powell is also likely to act as a bearish factor for the gold traders as the Federal Reserve (Fed) Boss is anticipated to hint at a faster rate hike and balance sheet normalization.

Join us on FB and Twitter to stay updated on the latest market events.