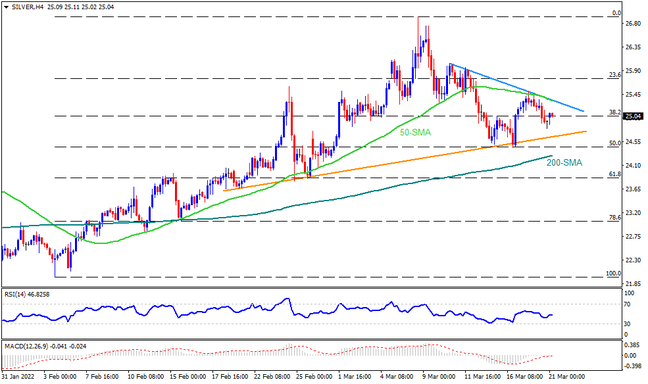

Silver’s U-turn from 50-SMA gains support from downbeat RSI, not oversold, to direct the sellers towards a monthly support line of around $24.50. While the MACD conditions hint at the receding bearish bias and suggest a bounce off the stated trend line support, the 200-SMA level surrounding $24.30 acts as a last defense for the bulls. Should the bright metal drop below $24.30, the bears will tighten grips while aiming 61.8% Fibonacci retracement of February-March upside near $23.80.

Meanwhile, recovery moves will have a tough time crossing the $24.35-40 resistance confluence including the 50-SMA and a downward sloping resistance line from March 10. If at all the silver buyers manage to cross the $24.40 hurdle, the bulls will target the $26.10 level comprising multiple tops marked in the last three two weeks. It’s worth noting, however, that a sustained run-up beyond $26.10 could open doors for the metal’s rally challenging the monthly top close to $27.00.

Overall, silver prices are likely to witness further declines but the room to the south is limited.

Join us on FB and Twitter to stay updated on the latest market events.