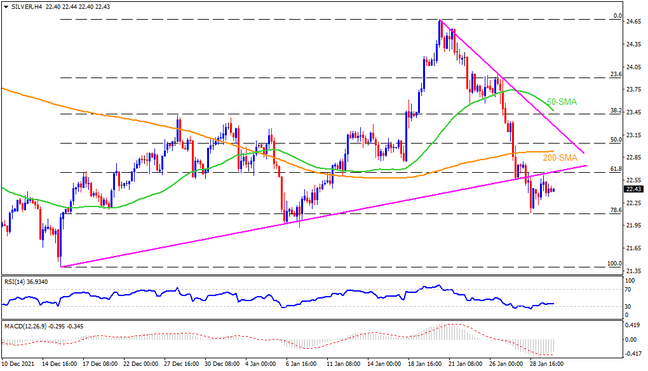

Silver prints corrective pullback around three-week low, bouncing off 78.6% Fibonacci retracement (Fibo.) of December 15 to January 20 upside. It’s worth noting, however, that the MACD remains bearish and the RSI is off the oversold territory while silver prices keep a downside break of a seven-week-old ascending trend line. As a result, XAGUSD bears remain hopeful to revisit the $22.00 support. Following that, lows marked in December and September of 2020 around $21.40 become crucial to watch.

On the flip side, silver’s recovery moves beyond the previous support line, around $22.65, will be challenged by the 200-SMA level of $22.95. Also acting as a nearby upside hurdle is the $23.00 round figure, a break of which will direct buyers towards a fortnight-old resistance line, around $23.45. Should silver prices remain firmer past $23.45, the 50-SMA level near $23.60 as a last line of defense for bears, following that the metal’s run-up towards the $24.00 round-figure and January’s peak of $24.68 should return to the charts.

Join us on FB and Twitter to stay updated on the latest market events.