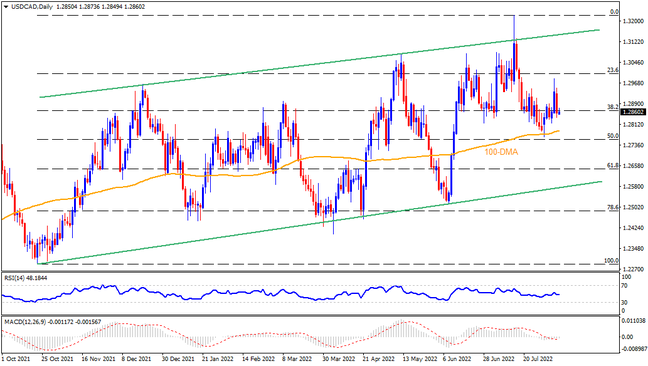

USDCAD extends the week-start pullback from a three-week high inside an upward sloping trend channel established since late October 2021. Given the downbeat RSI and the bearish MACD signals, the Loonie pair is likely to remain pressured inside the bullish chart formation. However, the 100-DMA support near 1.2785 could challenge the bears. Also acting as a downside filter are the 50% and 61.8% Fibonacci retracements of October 2021 to July 2022 upside, respectively near 1.2755 and 1.2640. In a case where the pair drops below 1.2640 support, the bears could well challenge the bullish pattern while poking the 1.2570 key support.

Alternatively, recovery moves could aim for the latest swing high near 1.2985 and the 1.3000 psychological magnet. Following that, multiple tops marked near 1.3075-80 could challenge the USDCAD bulls. However, the aforementioned channel’s resistance line, close to 1.3150 will be a tough nut to crack for the buyers afterward. Even if the pair rises past 1.3150, the latest swing high surrounding 1.3230 will be in focus.

Overall, USDCAD remains on the bull’s radar but intermediate pullbacks can’t be ruled out.

Join us on FB and Twitter to stay updated on the latest market events.