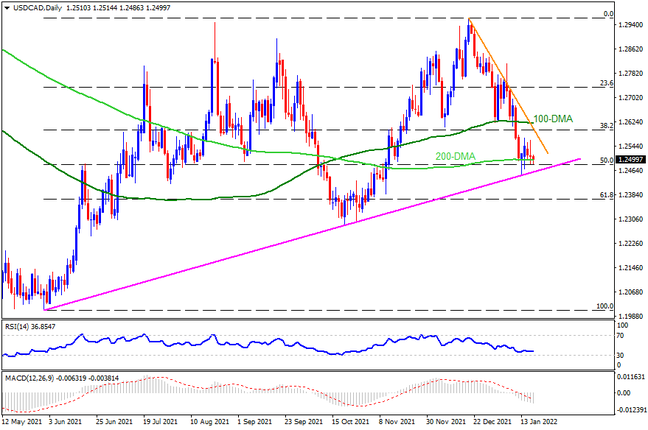

Although USDCAD buyers keep lurking around an upward sloping trend line from June, failures to stay decisively above the 200-DMA keep sellers hopeful of breaking the 1.2450 support. Adding to the bearish bias are the downbeat MACD and RSI conditions. That said, 61.8% Fibonacci retracement (Fibo.) of June-December 2021 advances, near 1.2370, is likely next support to watch on a clear break of 1.2450. It’s most likely that the RSI will turn oversold at the crucial Fibo. level and trigger a corrective pullback, if not then October’s low of 1.2287 will be on bear’s radar.

Alternatively, a disappointment by the monthly Canadian CPI could trigger a much-awaited rebound of the Loonie pair, which will need validation from Friday’s peak of 1.2570. Following that, a convergence of the 100-DMA and a monthly resistance line, around 1.2620, will be crucial for the USDCAD bulls to watch. Should the pair buyers manage to cross the 1.2620 hurdle, the odds of witnessing a run-up towards the monthly high of 1.2813 can’t be ruled.

Join us on FB and Twitter to stay updated on the latest market events.