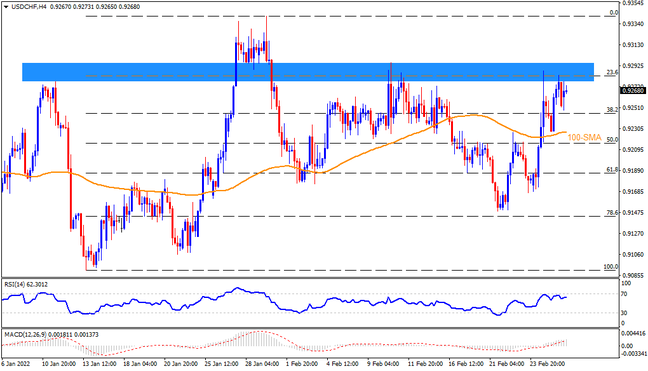

USDCHF posted weekly gains but eased from the short-term key horizontal area as Ukraine-Russia headlines controlled safe-haven pairs. That said, the risk-barometer currency pair retreated from a seven-week-old broad resistance zone, between 0.9275 and 0.9295, by the end of Friday. In addition to the market’s risk appetite, Swiss Q4 GDP will also make USDCHF interesting, not to forget the latest pullback. Hence, a firmer GDP and improvement in the market’s mood may extend the recent declines towards the 100-SMA level near 0.9220 before challenging the latest swing low near 0.9165. In a case where the quote drops below 0.9165, the monthly bottom and 78.6% Fibonacci retracement of January’s upside, surrounding 0.9150, will be crucial to watch for the bears.

Meanwhile, an extended risk-aversion wave, coupled with downbeat Q4 GDP will propel the USDCHF prices to battle the 0.9275-95 zone. Also acting as an upside filter is the 0.9300 threshold. Should the pair rise past-0.9300, January’s peak of 0.9340 will test the bulls ahead of directing them to November 2021 high close to 0.9375.

Overall, USDCHF may witness pullback moves should the Swiss GDP come in stronger than 0.3% expected. It’s worth noting that easing pessimism and a firmer reading near or beyond the previous 1.7% will be a boost to the pair’s downside momentum.

Join us on FB and Twitter to stay updated on the latest market events.