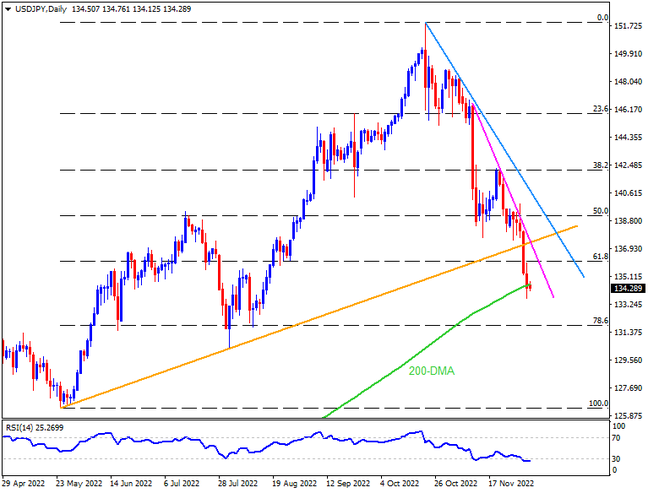

USDJPY is under immense pressure as it breaks the 200-DMA support, as well as marks the 3.5-month low. Even though the oversold RSI suggests a mild corrective bounce, the trend appears bearish after it broke an upward-sloping support line from late May. That said, the bears currently aim for the 78.6% Fibonacci retracement level of the pair’s May-October upside, around 132.00. If the quote fails to rebound from the key Fibonacci retracement level, the August month’s low near 130.40 and the 130.00 round figure may act as the last defense of the buyers.

Alternatively, recovery moves need to provide a daily closing beyond the 200-DMA level of 134.60 to tease intraday buyers. Even so, a corrective bounce needs to cross the 137.40 resistance confluence comprising the previous support line from May and a monthly descending trend line. Should the quote rises past 137.40, another trend line from October 21, close to 140.25, will be crucial before giving control to buyers.

Overall, USDJPY is likely to witness further downside towards 132.00 but further downside appears bumpy.

Join us on FB and Twitter to stay updated on the latest market events.