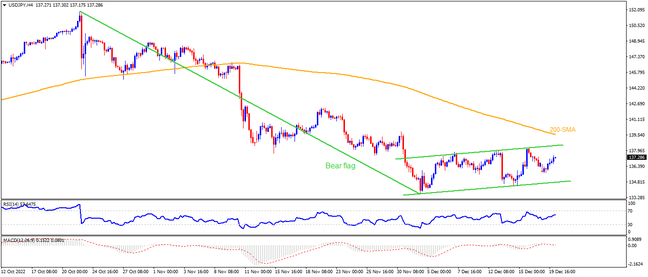

USDJPY is likely to end 2022 on a negative note, despite bracing for the biggest yearly run-up since 2013. However, the Yen pair portrays a bearish chart pattern, a bear flag on the four-hour play as traders keep their eyes on the Bank of Japan (BOJ). Given the downbeat oscillators and hawkish expectations from the BOJ, the bearish chart formation amplifies the downside expectations. As a result, bears could wait for a clear downside break of 134.90, to refresh the monthly low of 133.60. In that case, the August 2020 low near 130.40 and the 130.00 psychological magnet will gain major attention during the south run aiming for the theoretical target surrounding 120.00.

Meanwhile, the top line of the stated bear channel, close to 138.50, restricts short-term USDJPY recovery moves. A clear upside break of the same will defy the bearish chart pattern and could poke the 200-SMA surrounding 140.80. In a case where the Yen pair buyers manage to cross the last hurdle, namely the 200-SMA, late November swing high near 142.25 and the 145.20 resistance could flash on their radars.

Overall, USDJPY is on the bear’s radar after two years of a bullish move.

Join us on FB and Twitter to stay updated on the latest market events.