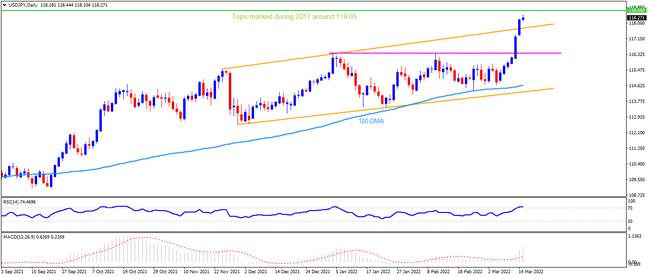

USDJPY cheers the greenback’s robust strength ahead of the Fed’s widely anticipated rate-hike to refresh five-year high. In doing so, the yen pair defied an upward sloping trend channel from late November, backed by the bullish MACD signals. However, overbought RSI and double tops around 118.65 could challenge the quote’s further upside. In a case where the pair rallies past 118.70, the 120.00 psychological magnet will offer an intermediate halt on the way to the early January 2016 peak surrounding 121.70.

Meanwhile, a pullback is more likely and could lure risk-taking sellers if the quote offers a daily closing below 117.70. Following that, the highs marked in January and February of 2022, near 116.35, will be on the bear’s radar. Though, the 100-DMA and an ascending trend line from late 2021, respectively around 114.60 and 114.35, will act as the last defenses for the pair buyers, a break of which will give controls to the sellers.

Overall, USDJPY may witness a pullback but bulls can keep the reins until the quote drops below 114.35.

Join us on FB and Twitter to stay updated on the latest market events.