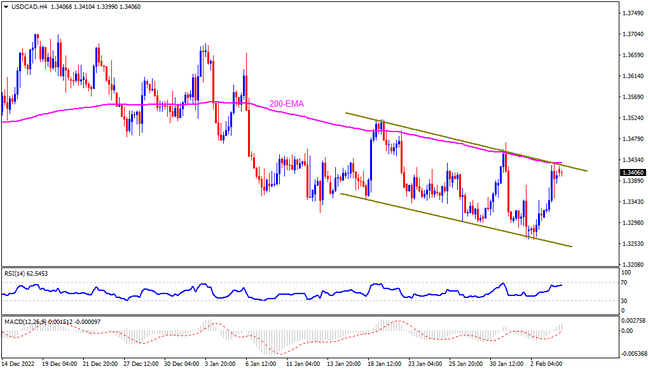

Friday’s US jobs report finally offered the much-needed bounce to the USDCAD pair. However, the Canadian employment numbers and Bank of Canada (BoC) Governor Tiff Macklem’s speech makes the current week all the more important for the Loonie pair traders. Also making the quote interesting is the latest piercing of the 1.3430 resistance confluence, comprising the 13-day-old bearish channel’s top line and 200-EMA. It’s worth noting that the oscillators aren’t quite impressive for the bulls and hence the pair buyers must wait for successful trading beyond the 1.3430 hurdle to retake control. Even so, the January 19 swing high near 1.3520 could probe the upside momentum before directing prices towards the previous monthly top surrounding 1.3685.

Meanwhile, USDCAD pullback remains elusive unless staying beyond 1.3350 support, a break of which could recall bears targeting the late 2022 bottom surrounding 1.3225. During the fall, the stated descending channel’s lower line, close to 1.3250 may act as an intermediate halt. In a case where the Loonie bears dominate past 1.3225, the 1.3000 psychological magnet may act as a buffer during the south-run targeting September 2022 low near 1.2965.

Overall, USDCAD bears are running out of steam as they approach this week’s key data/events.

Join us on FB and Twitter to stay updated on the latest market events.