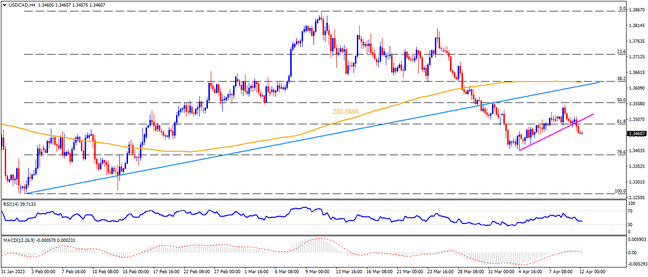

Be it a clear downside break of the 10-week-old ascending trend line or sustained trading below the 200-SMA, not to forget the latest fall below one-week-long rising trend line, USDCAD has it all to keep its place on the bear’s radar. The quote’s further downside, however, hinges on the Bank of Canada (BoC) monetary policy decision and the US Consumer Price Index data, as well as the FOMC Meeting Minutes. That said, the monthly low of around 1.3400 and multiple levels marked near the 78.6% Fibonacci retracement of the pair’s February-March upside, close to 1.3390, could test the Loonie pair sellers. In a case where the bears keep the reins past 1.3390, February’s low of around 1.3260 will be in focus.

Meanwhile, USDCAD recovery initially needs to cross the weekly support-turned-resistance of around 1.3500 before poking the 50% Fibonacci retracement hurdle, around 1.3560, to convince intraday buyers. Even so, the previous support line from early February, close to 1.3615-20, could challenge the upside momentum. If at all the Loonie pair manages to cross the 1.3620 hurdle, a convergence of the 200-SMA and 38.2% Fibonacci retracement will act as the final defense for bears near 1.3630. Should the quote remains firmer past 1.3630, backed by price-positive fundamentals, a run-up towards 1.3740 and 1.3800 can’t be ruled out.

To sum up, USDCAD is well-set for further downside on a key day for the pair traders.

Join us on FB and Telegram to stay updated on the latest market events.