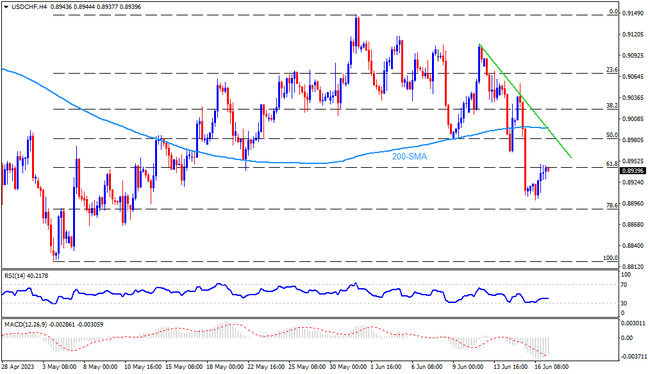

USDCHF eyes another visit to the yearly low, after a two-week downtrend, as it braces for the Swiss National Bank (SNB) Interest Rate Decision, expected 1.75% versus 1.50% prior. In doing so, the Swiss Franc (CHF) pair fades Friday’s bounce off the lowest levels in five weeks by retreating from the 61.8% Fibonacci retracement of its May 04-31 upside. Given the below 50.0 levels of the RSI (14) line, it is likely to witness a bumpy road towards the south, suggesting a bounce off the 78.6% Fibonacci retracement level of 0.8890. In a case where the quote fails to recover from 0.8890, the yearly low of around 0.8820 marked in the last month will be in the spotlight. It’s worth noting that the pair’s weakness past 0.8820 highlights the yearly 2021 bottom surrounding 0.8757 as the last defense of the buyers.

On the contrary, USDCHF recovery may initially aim for the 50% Fibonacci retracement level of 0.8980. Following that, a convergence of the 200-SMA and a one-week-old descending resistance line of around 0.9000 will be in focus. Should the quote manage to remain firmer past 0.9000, the bulls can aim for 0.9030 ahead of confronting multiple hurdles around 0.9110. It’s worth noting that the previous monthly high of around 0.9150 is the last stand for the bears, a break of which could allow the buyers to aim for the yearly high of 0.9440 marked in February.

Join us on FB and Telegram to stay updated on the latest market events.