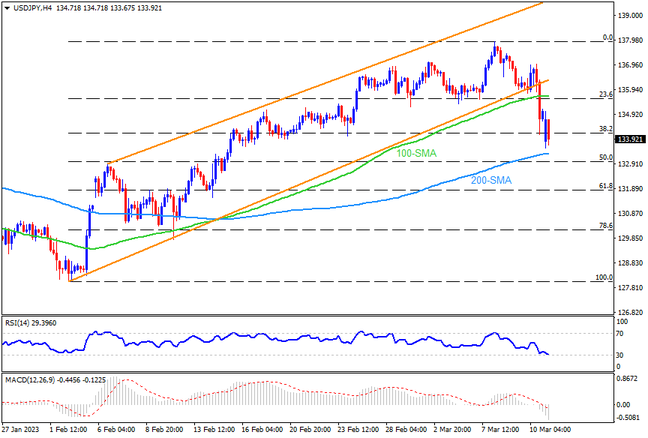

USDJPY marked a second consecutive weekly loss, as well as broke an ascending trend channel, as BoJ Governor Haruhiko Kuroda departs after the decade-long workmanship. The bearish break also gains attention as the quote slips beneath the 100-SMA for the first time in more than a month. However, the nearly oversold RSI and 200-SMA, around 133.30 at the latest, challenge the Yen pair’s further downside. Following that, the 50% Fibonacci retracement level of February-March advances, near 132.90, acts as the last defense of the buyers before directing sellers towards the 130.00 round figure, as well as the February 10 swing low surrounding 129.80.

Meanwhile, USDJPY recovery remains elusive unless the quote remains below the 135.65-70 resistance confluence, including the 100-SMA and the aforementioned channel’s lower line. Should the Yen pair manage to remain firmer past 135.70, the 137.00 could test the bulls before highlighting the monthly high of 137.90, the stated channel’s top line, near 139.10, and the 140.00 psychological magnet.

Overall, USDJPY is on the bear’s radar and is likely to decline further but the 200-SMA may test the further downside momentum.

Join us on FB and Telegram to stay updated on the latest market events.