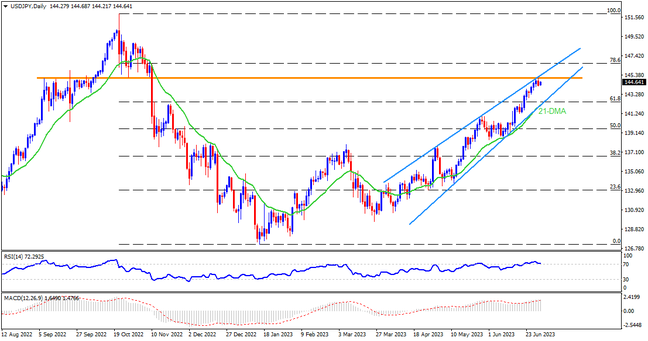

USDJPY’s U-turn from an eight-month high has significance for the sellers as it reverses from a convergence of the rising wedge bearish chart pattern’s top-line and a 10-month-old horizontal resistance area. Not only that, but the overbought RSI also suggests the end of a bullish reign. The same signals the Yen pair’s pullback to the 61.8% Fibonacci retracement of the October 2022 to January 2023 downturn, near 142.50. However, the bears need more than that to retake control, which in turn highlights a joint of the 21-EMA and bottom line of the stated wedge, close to 141.90 by the press time. Following that, the 140.00 round figure and March’s peak of 137.90 could become the seller’s favorite. Though, there will be a bumpy road for the Yen pair bears past 137.90 as lows marked in March and in January, respectively near 129.65 and 127.20, will be tough nuts to crack before directing the quote to the rising wedge confirmation’s theoretical target of 130.40 and then to the 130.00 round figure.

On the contrary, the USDJPY pair’s run-up beyond the aforementioned immediate resistance confluence, near 145.00-10, could aim for the 78.6% Fibonacci retracement level of 146.70 and then to the late October 2022 peak of around 148.85. Additionally acting as an important upside filter is the 150.00 round figure. It’s worth noting that the RSI conditions can keep challenging the Yen pair buyers on their way to the north while targeting the previous yearly top of around 152.00.

Overall, USDJPY is likely to witness fresh downside but a clear break of the 141.90 support is a must for sellers to retake control.

Join us on FB and Telegram to stay updated on the latest market events.