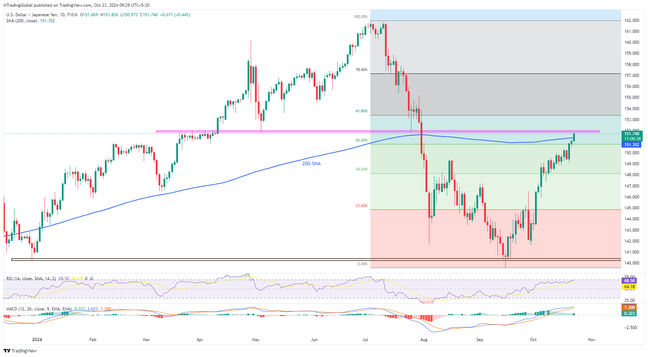

USDJPY has reached its highest point since July 31, rising for the third straight day after breaking the 200-day Simple Moving Average (SMA) early Wednesday. However, a seven-month-old resistance zone around 151.85-152.00 limits further gains of the Yen pair.

Bulls Need a Strong Push

The US Dollar’s strength and bullish MACD signals keep buyers hopeful. Yet, overbought RSI conditions and tough resistance mean a significant boost is necessary for further upward movement. Without this, the pair could quickly drop below the 200-SMA, leading to short-term selling.

Key technical levels to watch

In addition to the 200-SMA support at 151.35 and the resistance zone around 151.85-152.00, several important technical levels are crucial for USDJPY traders.

The 50% Fibonacci level near 150.80 will attract sellers if the price drops below the 200-SMA, along with the key threshold at 150.00. A drop to around 149.40 is possible if sellers gain control, and if the price falls past this level, September’s high of 147.20 and the 23.6% Fibonacci level at 144.85 will come into focus.

On the upside, a close above 152.00 could encourage buyers to target the 61.8% Fibonacci level, or Golden Ratio, near 153.40. If momentum continues, potential targets may include June’s low of 154.55 and the 78.6% level at 157.20.

Decisive move ahead…

While buyers seem in control, the struggle to surpass key resistance amid overbought conditions and upcoming PMI data could lead to a necessary pullback. Traders should proceed with caution as the next moves in USDJPY will be crucial.

Join us on FB and Twitter to stay updated on the latest market events.