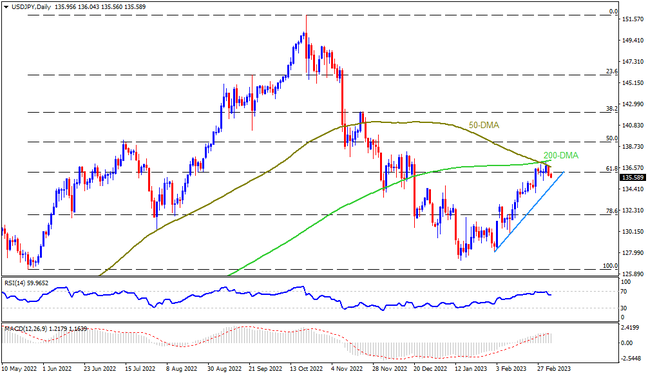

USDJPY marked the first weekly loss in three as the key Bank of Japan (BoJ) Monetary Policy Meeting and the US Nonfarm Payrolls (NFP) looms. The Yen pair’s latest retreat could be cited as a failure to cross the 200 and 100-DMA. Adding strength to the pullback move could be the overbought RSI (14). However, the bullish MACD signals and a three-day-old ascending support line, around 134.15 by the press time, challenge the quote’s immediate downside. Following that, the 78.6% Fibonacci retracement level of the pair’s May-October 2022 run-up, near 131.75, could lure the bears before directing them to the 130.00 psychological magnet and the last January’s low, close to 127.20.

Meanwhile, the 100-DMA and the 200-DMA guard the USDJPY pair’s immediate recovery moves near 136.80 and 137.30 respectively. It’s worth noting that the risk-barometer pair’s successful run-up beyond 137.30 isn’t an open invitation to the bulls as the 50% and 38.2% Fibonacci retracement levels could challenge the further advances around 139.15 and 142.20 in that order.

Overall, USDJPY bulls are running out of steam ahead of BoJ Governor Haruhiko Kuroda’s last monetary policy show, as well as the key US jobs report for February.

Join us on FB and Telegram to stay updated on the latest market events.