Although the amount of gold central banks bought is lower than last year, it hits Q1 records. China and Singapore are among the top buyers.

During the first quarter of 2023, Central banks’ global gold reserves got extra 228 tons of the precious metal. The first quarter numbers were 176% higher compared to the same period in 2022. It is the record pace in Q1 since the first time such data was provided by the World Gold Council back in 2000.

However, it is not only about records. Experts can interpret this data in different ways.

Who Bought the Most Gold in Q1?

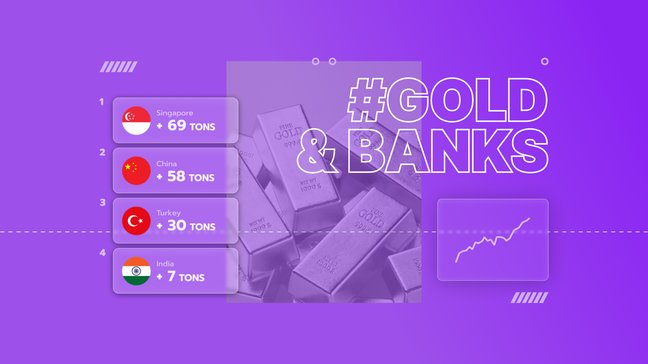

Four central banks are on the list of major yellow metal purchasers.

Singapore takes first place after adding 69 tons to its federal gold reserve. As stated by the Monetary Authority of Singapore, it was the first buying increase since June 2021 launched by a growing demand for gold not only in emerging markets.

China is second on the list of the biggest gold buyers in the first three months. The country purchased 58 tons. All in all, the People’s Bank of China added 120 tons of gold metal starting in November 2022.

That was expected, The Central Bank of the Republic of Turkey appeared in the top three of the largest precious metal buyers. Turkey was the #1 buyer last year. So, the trend continues, after the country’s central bank added 30 tons during the first quarter. What’s more, it inputs a partial ban on importing gold bullion.

India is the 4th country on our list after adding 7 tons to bring its total federal gold reserve holding to as high as 795 tons.

Who Sold the Most Gold in Q1?

Now, let’s have a look at the list of top gold sellers.

Kazakhstan is on top of the list selling 20 tons followed by the Central Bank of Uzbekistan with 15 tons. Cambodia is in the top 3 with 10 tons of gold sold in Q1.

The selling trend may decrease, as gold prices exceed $2,000 per ounce. It means fewer countries would be eager to sell the asset. What’s more, if the de-dollarization continues, it will force central banks to boost their gold reserves.

In simpler words, we may see how the gold-buying pace may come to an end pretty soon. Some countries are no longer interested in holding USD as the main reserve asset for their central banks.

May the trading luck be with you!