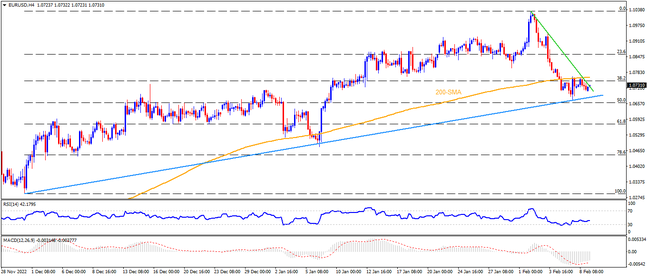

EURUSD fades bounce off the 10-week-old ascending support line as the weekly resistance line and the 200-SMA challenge buyers. Adding strength to the downside bias are the bearish MACD signals and downbeat RSI (14). As a result, the quote is likely to return to the bear’s table after a four-month absence. That said, a downside break of the stated support line, close to 1.0670, could act as a trigger for the downside targeting the previous monthly low surrounding 1.0480. It’s worth noting that the 61.8% and 78.6% Fibonacci retracement of the pair’s November late November 2022 to early February peak, respectively near 1.0570 and 1.0450, could act as extra downside filters to watch before targeting the late November swing low of 1.0290.

Meanwhile, recovery moves need validation from the 200-SMA, around 1.0765 at the latest. Following that, the EURUSD pair’s run-up towards 1.0800 and then to 1.0930 can’t be ruled. In a case where the prices remain firmer past 1.0930, the 1.1000 psychological magnet and the monthly high of 1.1033 should gain the market’s attention. It should be observed that the rally beyond 1.1033 enables bulls to aim for a March 2022 peak of 1.1185.

To sum up, EURUSD buyers appear running out of steam but the bears must conquer the multi-day-old support line to return to the driver’s seat.

Join us on FB and Twitter to stay updated on the latest market events.