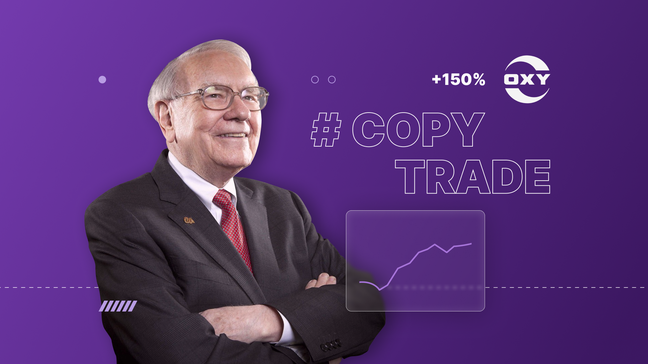

Following proven experts in investing is a good strategy, especially during a market crash. While commodities show a price decline, copying experienced traders seems like a risk-free strategy in the long run. The news that Warren Buffet is about to acquire 50% of the oil giant can indicate the most favorable sector to invest in.

The Big Purchase

Buffett's Berkshire has officially received permission to acquire half of Occidental Petroleum after a huge company’s stock price increase. As a result, the oil giant managed to push its gains to almost 150% in 2022.

The application was filed back in July. Recently, the Federal Energy Regulatory Commission established permission to let Berkshire buy the major part of the oil company’s stocks. The purchase is expected to take place via secondary market transactions. The permission was supported by the idea such a purchase will not be to the detriment of competition in the sector. According to the official statement, the acquisition was “consistent with the public interest”.

Currently, Berkshire owns 20.2% of the company’s assets equal to 188.5 million shares. Additionally, Buffett's fund holds preferred stocks issued by Occidental. Today, their value is around $10 billion in additional common shares and other warranties for around $5 billion. Experts say Buffet will try to continue acquiring the company and buying as much as he can.

Small Investors Get Inspired

The acquisition keeps smaller investors really inspired. They are very likely to follow suit. This fact makes Occidental stocks among the best retail assets in 2022. What’s more, the oil giant has got on the list of best-performing stocks in the S&P 500 mainly thanks to surging oil prices.