More Junk-Rated Companies to Default in 2024

According to Moody’s report released on Thursday, defaults by American businesses with subpar junk credit ratings are likely to rise in Q1 2024.

Moody's analysts say defaults among the lowest-rated U.S. corporations will level off at 4.1% by the end of 2024, having peaked at 5.8% this quarter from 5.3% in November.

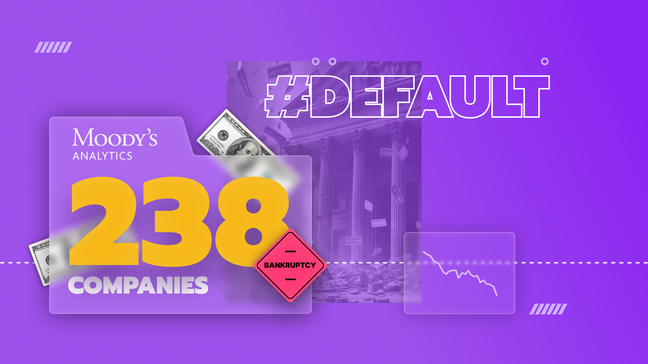

In the Q3 of 2023, Moody's lists 238 corporate debtors on its "B3 Negative and Lower" list against 218 companies the previous year. Experts think there's a greater chance of debt default for these organisations.

sehingga 200%

dari 0 pip

Copy Trading

This represents the highest percentage of U.S. speculative-grade names since mid-2021, at 16%. The radio platform iHeart Communications and Spirit Airlines (SAVE.N were among the names placed on the list last quarter. On Tuesday, the transaction was halted.

Most of the defaults that took place in Q4 in 2023 were mainly privately owned companies. They tried to modify their existing debt with the help of distressed exchanges as the last chance to avoid bankruptcy. Meanwhile, the number of defaults grew to 1.8x compared to 1.3x in 2023.

The situation reflected several issues. Declining earnings, weakening liquidity, and growing refinancing risks are among the main challenges. The majority of companies listed in the Moody’s report represent the healthcare sector. They have faced the highest default risk in 2023.

In total, junk-rated organisations have over $1.8 trillion of debt. According to forecasts, it will mature between 2024 and 2028 making it harder for borrowers to refinance their debts or access new ones even though the FED is expected to cut rates sooner.

May the trading luck be with you!